Buy Your First Home With As Little As 5% Deposit

The Government’s First Home Loan Deposit Scheme Is Helping People Buy Their First Home Sooner.

How It works

The First Home Loan Deposit Scheme is a government initiative that started on 1 January 2020.

The initiative provides a guarantee which allows eligible first home buyers to buy a home with a deposit of as little as 5% without needing to pay Lenders Mortgage Insurance (LMI).

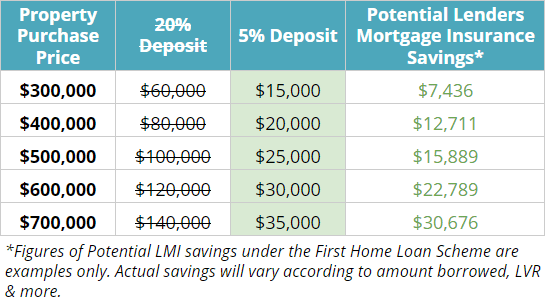

This could equate to a saving of between $7,000 – $30,000+, and mean getting into a home much faster.

Eligibility Requirements

You may be eligible if you:

- Are at least 18 years old

- Are an Australian citizen or Permanent Resident

- Are buying your first home to live in

- Are a single with a taxable income of $125,000 or less OR a couple (married or in a de facto relationship) with a combined taxable income of $200,000 or less

- Purchase a home for less than the amount set out by the National Housing Finance and Investment Corporation (NHFIC)

How to apply

The initiative is restricted to eligible loans from select lenders, with only 35,000 supported each financial year.

If you want to buy a home with as little as 5% deposit under the First Home Loan Deposit Scheme, simply register your details below or call 02 4961 4985 to check your eligibility with your First Home Buyer Specialist.

We’ll also help you check to see if you are eligible for first home buyer assistance grants and concessions such as the $10,000 NSW First Home Owner Grant or stamp duty concessions.

Purchase Sooner with a 5% deposit

Are you eligible

You will be eligible for the First Home Buyer Guarantee if you can say “Yes” to all of the following:

You are one of the first 35,000 applicants across Australia after applications opened on July 1, 2022.

You are an Australian citizen or Permanent Resident.

You are over the age of 18.

Your net income for the last financial year is less than $125,000 if you’re applying individually, or less than $200,000 if you’re applying as part of a couple.

You are buying a property to live in yourself (in other words, you’re not buying an investment property to rent out).

You (and your partner if you’re purchasing jointly) have never owned property in Australia before

How much Can I Buy For?

You can purchase a brand new house, vacant land and build or an established house under the First Home Guarantee. You will need to ensure that the property is sold for less than the property price cap set for your area. To find out the exact property price cap for your area, please contact us and one of our specialists will assist you.

will the Government own my house?

No, the Government will not own part of your house under this scheme. They are essentially just going guarantor for your loan. They are putting down a guarantee to the bank that if you had to sell your house and there was a short fall, they would cover it. They are basically replacing the function of a Lenders Mortgage Insurer (LMI) without the premium.

What Will My Home Loan Repayments Be?

This depends on how much you borrow, your loan term and the comparison interest rate. Standard loan terms in Australia are 25 and 30 years. You can use our Wisebuy Home Loans loan repayment calculator to help you work out your repayments of different loan amounts over different terms and at different interest rates.

Are There Any Other First Home Buyer Concessions?

Yes. For example, eligible first home buyers in New South Wales receive a transfer (stamp) duty concession. It could save you thousands of dollars when you buy your first home. You can use our Wisebuy Home Loans stamp duty calculator to work out if you’re eligible for a full or partial concession.

Our expert team at Wisebuy Home Loans works with participating lenders in the First Home Guarantee Scheme. We arrange home loans for a living and first home buyer loans are one of our specialties. We can help you to find the right loan for your needs.

We can guide you every step of the way, right from helping you organise a home loan pre-approval so you can negotiate and buy with confidence, through to taking ownership and moving into your new home.

Contact our team of Mortgage Brokers in Newcastle, NSW to arrange a free, no-obligation consultation. Or click get started below to start the process online. We’d be happy to answer any questions you have.