Whether you’re taking your initial steps into property ownership or are a seasoned investor with a keen eye for valuable real estate opportunities, it’s undeniable that you’ll come across the term “mortgage” in the process.

Deciding what type of mortgage suits your situation best can be confusing, which is why we’ve put together this brief guide to provide a little more clarity. In this article, we’ll explain different types of mortgages as well as the pros and cons of each type of mortgage.

What is a Mortgage?

Before we go any further, let’s break down what exactly a mortgage is. The concept of a mortgage simply refers to the terms of lending or borrowing money.

Most people don’t have the funds to purchase a property outright, which is where mortgages come in. A mortgage helps to provide those funds upfront for the purchase and can be repaid over a set amount of time.

What Are the Different Types of Mortgages?

Because there are different scenarios for buying property, mortgages have been split into a few different types to cater to borrowers’ financial needs. Here are a few of the main ones that you need to be aware of:

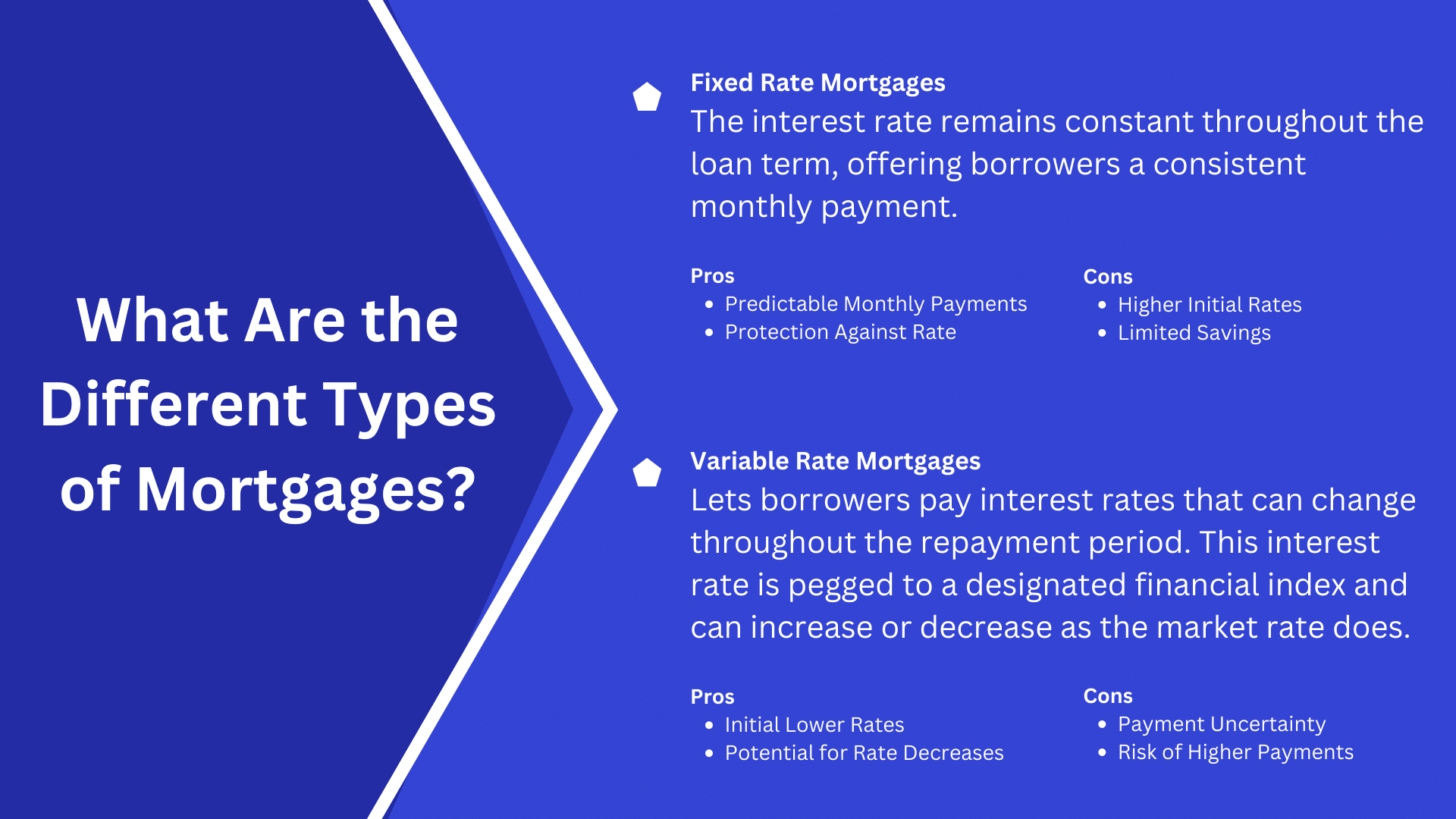

Fixed Rate Mortgages

Fixed-rate mortgages are one of the most popular types among homebuyers, and with good reason: the interest rate remains constant throughout the loan term, offering borrowers a consistent monthly payment. This type of mortgage provides a sense of financial security, as homeowners won’t need to worry about any changes in interest rates and can plan way ahead financially.

Pros:

- Predictable Monthly Payments: Borrowers can plan their budgets confidently since the monthly payment remains unchanged.

- Protection Against Rate Increases: Even if market interest rates rise, the fixed rate remains unaffected.

Cons:

- Higher Initial Rates: Fixed-rate mortgages often start with higher interest rates compared to adjustable-rate options.

- Limited Savings Potential: If market rates decrease, borrowers with fixed-rate mortgages might miss out on potential savings.

Variable Rate Mortgages

On the other side of the coin are variable-rate mortgages. This mortgage type lets borrowers pay interest rates that can change throughout the repayment period, making it a more unpredictable option. This interest rate is pegged to a designated financial index and can increase or decrease as the market rate does. The main benefit of this characteristic is that borrowers could potentially enjoy lower interest rates, depending on the market.

Pros:

- Initial Lower Rates: Variable rate mortgages often begin with lower interest rates, leading to lower initial monthly payments.

- Potential for Rate Decreases: Borrowers could benefit if interest rates in the market decrease during the loan term.

Cons:

- Payment Uncertainty: Monthly payments can vary significantly due to interest rate adjustments.

- Risk of Higher Payments: If interest rates rise, borrowers might face higher monthly payments, potentially straining their budgets.

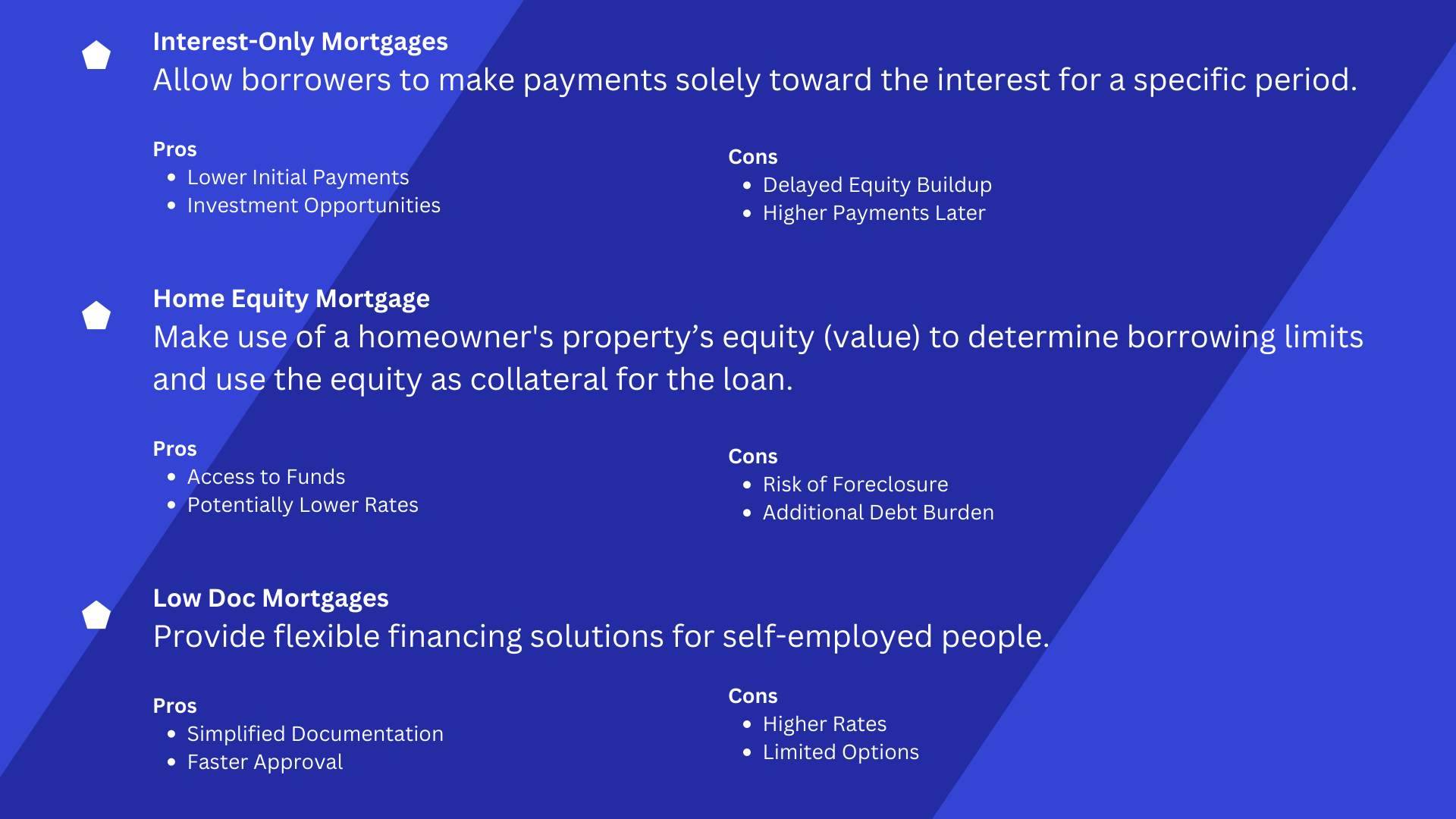

Interest-Only Mortgages

Interest-only mortgages allow borrowers to make payments solely toward the interest for a specific period. This type of mortgage is typically favoured by investors as a way to negatively gear their properties in order to reap tax benefits.

Pros:

- Lower Initial Payments: Payments during the interest-only period are lower, which can help borrowers manage their finances in the short term.

- Investment Opportunities: Borrowers can allocate the saved funds towards investments or other financial goals.

Cons:

- Delayed Equity Buildup: Since no principal is paid during the interest-only phase, equity accumulation is postponed.

- Higher Payments Later: After the interest-only period, borrowers will face larger payments, potentially causing financial strain.

Home Equity Mortgage

Home equity mortgages are a little different from the others we’ve outlined above. They make use of a homeowner’s property’s equity (value) to determine borrowing limits and use the equity as collateral for the loan.

Pros:

- Access to Funds: Homeowners can tap into their home’s equity for various purposes like home improvements or debt consolidation.

- Potentially Lower Rates: Home equity loans might offer lower interest rates compared to other types of credit.

Cons:

- Risk of Foreclosure: If the borrower fails to repay the loan, the home could be at risk of foreclosure.

- Additional Debt Burden: Taking on more debt could lead to financial strain if not managed carefully.

Low Doc Mortgages

Low doc mortgages are designed for self-employed individuals or those with non-traditional income sources who may have difficulty providing traditional income verification. While they offer flexibility, it’s important to weigh their advantages and disadvantages.

Pros:

- Simplified Documentation: Borrowers can apply with less stringent income verification, making it accessible for self-employed and freelancers.

- Faster Approval: The reduced documentation process can lead to quicker approval times.

Cons:

- Higher Rates: Low doc mortgages often come with higher interest rates due to the increased risk to lenders.

- Limited Options: Borrowers might have fewer loan options and higher fees compared to traditional mortgages.

Choosing the Right Mortgage for You

A mortgage can last anywhere between a couple of years to decades, and the decision you make can affect your financial circumstances and goals in the long run. Remember to always do your research and get advice from a trusted real estate professional so that you can navigate between the different mortgage types to find one that fits you best.

As Newcastle’s leading mortgage services provider, we at Wisebuy Home Loans have helped countless other homebuyers like you in getting the right mortgage they need. Our expert team can provide you with tailored advice, ensuring you select a mortgage that aligns perfectly with your financial journey. Looking for assistance with the mortgage application process? Contact us, and we’ll be happy to guide you towards getting your dream home!