NSW Labor government plans to put and end to the stamp duty reforms introduced by Dominic Perrottet. The current policy allows first home buyers to select pay annual property tax on homes valued up to $1.5 million. This can avoid having to pay upfront stamp duty of up to $66,000 which could be used to contribute towards the deposit instead.

The Labor government is planning to remove the option to pay annual land tax from the 1st of July 2023 and make changes to stamp duty exemptions for first home buyers. The exemption will be available for first home buyers purchasing for up to $800,000. This is a $200,000 increase from the existing policy which will allow more first home buyers to avoid paying stamp duty altogether. Stamp duty concessions will be available for purchases between $800,000 – $1,000,000, up from the existing $800,000 threshold.

First home buyers that are already paying annual land tax will continue to do so, as will buyers that take this option before July 1.

These changes could dramatically reduce the amount some first home buyers can purchase for. It essentially means that some first home buyers will need an additional $66,000 to make the same purchase prior to July 1.

First home buyers purchasing for less than $800,000 will benefit most from these changes.

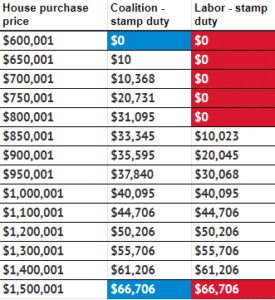

Stamp duty changes for first home buyers

- First home buyers will pay no stamp duty on homes worth up to $800,000, and a concessional rate for homes up $1 million, under the NSW Labor government.

- The government aims for the policy to take effect from July 1.

- Homes worth up to $650,000 currently qualify for a stamp duty exemption, while homes worth up to $800,000 qualify for a concession.

- The Labor government aims to repeal the former Coalition government’s opt-in property tax scheme, which lets first-time buyers of higher-cost properties avoid stamp duty, from June 30.

- Until then, first home buyers can choose between upfront stamp duty or a smaller annual property tax on properties worth up to $1.5 million.

- Those who have opted to pay the property tax before that date, will continue to be able to use the property tax.

Compare the changes:

The biggest savings are for first home buyers purchasing for $800,000 with a massive savings amount of $31,095 while a $950,000 purchase will only see a savings of around $7,000.

Regional first home buyers are set to reap the rewards of these changes given the property price brackets while buyers in Sydney are unlikely to benefit at all.